It hasn’t been that long ago when the first words a Realtor would hear from a prospective buyer were, “what kind of foreclosures deals are out there?” Fast forward to today. The question is, “what’s out there that I can afford?”

It hasn’t been that long ago when the first words a Realtor would hear from a prospective buyer were, “what kind of foreclosures deals are out there?” Fast forward to today. The question is, “what’s out there that I can afford?”

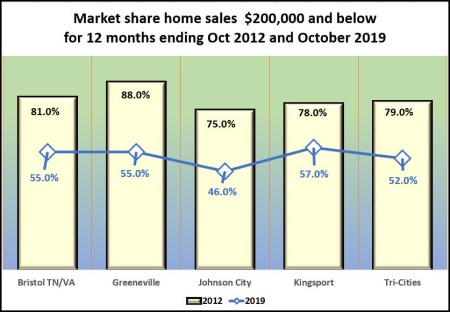

Driven by a super tight inventory, single-family home prices have been increasing faster than wages in the Tri-Cities region. It’s created a structural change in the market. That’s most evident when you look at both the sales and availability of homes in the $200,000 and below range.

Why $200,000?

Until recently, that price range dwarfed all others across the region. That’s not the case anymore. In fact, there has been a major shift in both sales and listings in that Goldilocks zone.

Until recently, that price range dwarfed all others across the region. That’s not the case anymore. In fact, there has been a major shift in both sales and listings in that Goldilocks zone.

So, what happened, and why?

The housing crash and the Great Recession was a dreadful flow to economies and home values across the nation. Some parts of the local economy – jobs for example – are just now recovering. That’s not the case for housing. It led the region out of the recession and continues to outperform most other economic components.

The local housing market didn’t suffer as much as many other markets because there was no local housing bubble driven by inflated prices and financed with subprime loans. But it took a hit because the first thing consumers do with there’s economic problems is to cut back on big purchases. And buying a home is one of the biggest financial purchases most people and families will ever make.

The local housing market didn’t suffer as much as many other markets because there was no local housing bubble driven by inflated prices and financed with subprime loans. But it took a hit because the first thing consumers do with there’s economic problems is to cut back on big purchases. And buying a home is one of the biggest financial purchases most people and families will ever make.

But there was another side to the recession’s affect on the local housing market. It opened the door to individuals who were financially positioned to take advantage of housing bargains. It was also a bonanza for investors. Some were mom and pop investors who snapped up bargains that added to their rental inventory. Another group of investors were and continue to be the flippers. They buy homes to upgrade them and put them back on the market.

But there was another side to the recession’s affect on the local housing market. It opened the door to individuals who were financially positioned to take advantage of housing bargains. It was also a bonanza for investors. Some were mom and pop investors who snapped up bargains that added to their rental inventory. Another group of investors were and continue to be the flippers. They buy homes to upgrade them and put them back on the market.

Most of this activity and focus were on homes in the $200,000 and under price range. After a couple of years, it absorbed the surplus inventory of homes in the Goldilocks price range.

Local home sales were back to pre-recession levels in 2013. But it was during the summer of 2015 that buyers put the peddle to the metal and home sales took off. Annual sales were up 9.6% that year and 15.3% in 2016. The following year is when the inventory crunch started. And it hasn’t let up.

In 2012 the region had 10 months inventory of listings for homes in the $200,000 and below range. Last month it was a little better than three months. Listings in the $200,000 to $399,999 price range had 18 months of inventory in 2012. Today there’s six months of inventory in that price range. Six months of inventory is the normal market condition. So, for the first time, the Tri-Cities market is seeing normal market conditions for listings in the $200,000 to $399,999 price range.

The dark side of what’s happened is many of those homes where we now see normal market conditions are beyond the affordability range of many local residents. Technically, a person earning the median local wage has enough buying power to but a median-priced home. The trick is finding one of the homes in today’s marketplace.

Last month the median sales price for a home in the three-county Johnson City Metropolitan Statistical Area (MSA) was $164,900. The median listing price was $239,000.

The median sales price in the four-county Kingsport-Bristol MSA was $160,000, and the median listing price was $199,900.

The median is the point where half of the sales are above and half are below a price point.

If a buyer with the median household income in either of the region’s two metro areas allocated 30% of their income on housing – anything more than that is considered housing stressed – they need an income of just under $40,000 to buy one of those homes at the median sales price point. That assumes the buyer has good credit and a 28% front-end debt to income ratio. And if you look at what it takes for a family to three to afford a modest standard of living you’re looking at a $60,000 a year tab.

Today’s Tri-Cities housing market continues to see robust sales and price growth. That’s a good thing. It’s more vibrant now than it has been in decades. But since the new home industry has not been on the same recovery pace as existing sales. And since wages have not kept pace with home prices there’s an imbalance.

The bottom line is the Tri-Cities is on the cusp of having an escalating housing affordability problem.

Categories: REAL ESTATE

Love your analysis Don. They always over deliver for me. How does this look if Washington County VA is in the mix?

Thanks Logan. Glad you find the material useful. The conditions are basically the same if you expand the analysis to the county level. I did it with the Bristol TN/VA area because that’s the dominant part of that submarket.

Thanks Don. Makes perfect sense.

Don, I enjoyed your relaxed casual writing style to share this story along with the data points illustration. Very effective and educational. A story that will be repeated often. Great job…Jerry

Thanks Jerry. I’m trying to get away from the stogy data-laden reports to another form of storytelling.

Don, Your data is always very useful when clients ask me about our local housing market, availability and pricing. It helps them understand why the search for the perfect home might take some extra time to locate.

Thanks Larry.